gulche.ru

Learn

Request Wikipedia Page

Requested moves is a process for requesting the retitling (moving) of an article, template, or project page on Wikipedia. For retitling files, categories. If you need a page deleted, add the Category:Delete tag to it, and present your reasons for wanting it removed on the article's discussion page. (See Wikipedia. Go to Wikipedia and type WP:REQUEST into the search bar. · 1) Make sure the article isn't already on Wikipedia under another name. · 2) Go to WP. The best Wikipedia experience on your Mobile device. Ad-free and free of charge, forever. With the official Wikipedia app, you can search and explore 40+. Wiki page's content. For specific technical questions or help requests, please open a Technical Ticket(Troubleshooting; Error Code; Maintenance; Handy. Asking Wikipedia to Write Your Article. Wikipedia has a list called Requested Articles where you can request a specific article be written about your brand. Request may refer to: a question, a request for information; a petition, a formal document demanding something that is submitted to an authority. Request: A Wikipedia page of Walter White/Heisenberg in the BB universe. There is a Wikipedia page of him as a fictional character, but I. Wikipedia:Requests for page protection · Request protection of a page, or increasing the protection level. Request protection · Request unprotection of a page. Requested moves is a process for requesting the retitling (moving) of an article, template, or project page on Wikipedia. For retitling files, categories. If you need a page deleted, add the Category:Delete tag to it, and present your reasons for wanting it removed on the article's discussion page. (See Wikipedia. Go to Wikipedia and type WP:REQUEST into the search bar. · 1) Make sure the article isn't already on Wikipedia under another name. · 2) Go to WP. The best Wikipedia experience on your Mobile device. Ad-free and free of charge, forever. With the official Wikipedia app, you can search and explore 40+. Wiki page's content. For specific technical questions or help requests, please open a Technical Ticket(Troubleshooting; Error Code; Maintenance; Handy. Asking Wikipedia to Write Your Article. Wikipedia has a list called Requested Articles where you can request a specific article be written about your brand. Request may refer to: a question, a request for information; a petition, a formal document demanding something that is submitted to an authority. Request: A Wikipedia page of Walter White/Heisenberg in the BB universe. There is a Wikipedia page of him as a fictional character, but I. Wikipedia:Requests for page protection · Request protection of a page, or increasing the protection level. Request protection · Request unprotection of a page.

Please do not edit the article's talk page. If you object to a proposal listed in the uncontroversial technical requests section, please move the request to the. 1 Answer 1 Your hostname: hostname: 'gulche.ru',. contains a trailing slash. Remove it: hostname: 'gulche.ru',. and your code. Key Benefits: ✔️ Tailored Solutions: Customized strategies for Wikipedia page creation and Wikipedia content management. Your call for Wikipedia. Request apps that require approval by your org · Create Every document in your Wiki tab is called a page and every page is made of different sections. Edit requests are requests for edits to be made to a page where editors cannot or should not make the proposed edits themselves. Using Safari's reader mode often breaks formatting, tables, etc. on Wiki pages too I've noticed. Thank you for all your hard work! Requestors. To make a request for a permission, click "add request" next to the appropriate header and fill in the reason for wanting permission. I also don't think there is a way to get exactly what your looking for. If you ask MediaWiki to parse the page it is going to resolve all. Why do pages get deleted/nominated for deletion? · My page was nominated for deletion. Now what? · What if my page was already deleted? (Request for Undeletion). Reach consensus on the page's talk page and then request an edit by adding {{Edit protected}} to the talk page. If the talk page is protected too, use WP:RFED. This page in a nutshell: This page offers suggestions on how to request free images for Wikipedia articles. Some information in this essay appears to be out. This page lists requests for new language wikis of existing projects (to Wikipedia requests. Project, Official status, Status since, Notes. Wikipedia. Asking Wikipedia to Write Your Article. Wikipedia has a list called Requested Articles where you can request a specific article be written about your brand. Book a Call. What Are The Benefits of Creating a Wikipedia Page for Your Business? The largest benefit of Wikipedia is its sheer size and reach. It is one of. This page explains how to request images from other Wikipedians for Wikipedia articles. To request an image from a specific Wikipedian photographer. Wikipedia:Requests for permissions/Page mover · Administrator · Bot · Bureaucrat · CheckUser and Oversight · Edit filter helper · Edit filter manager. Step 5: Write About Yourself. There is a specific format for different subjects, such as a business page will demand separate content, and different info will. When you are ready to begin · Click the "Request an account" link below, and a wizard will assist you. If you're directed to complete a form in order to request. This page is the standard operating procedure manual for ACC tool users and ACC tool administrators. If you're looking to request a new account, click here to.

Paying Estimated Taxes On Roth Conversion

Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. See if converting to a Roth IRA makes sense for you. Use our Roth IRA Conversion Calculator to compare estimated future values and taxes. See if converting to a Roth IRA makes sense for you. Use our Roth IRA Conversion Calculator to compare estimated future values and taxes. Roth conversions are taxable and reportable. Any amount you convert is added to your taxable income for the year. There can be much to consider. A special exception has been created for conversions to Roth IRAs, so you won't pay a penalty on your conversion even if you're under age 59½. Estimated tax. The conversion amount would be reported as taxable income. You should consider federal, state, and local income taxes that would apply. Please consult a tax. If you own a traditional IRA or other non-Roth IRA, or have an old workplace retirement plan such as a (k), (b), or (b), you can pay taxes on your. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You. To convert to Roth, you would pay approximately $12, in taxes today, but in 20 years, you could have $22, more in total assets, which may make a Roth. Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. See if converting to a Roth IRA makes sense for you. Use our Roth IRA Conversion Calculator to compare estimated future values and taxes. See if converting to a Roth IRA makes sense for you. Use our Roth IRA Conversion Calculator to compare estimated future values and taxes. Roth conversions are taxable and reportable. Any amount you convert is added to your taxable income for the year. There can be much to consider. A special exception has been created for conversions to Roth IRAs, so you won't pay a penalty on your conversion even if you're under age 59½. Estimated tax. The conversion amount would be reported as taxable income. You should consider federal, state, and local income taxes that would apply. Please consult a tax. If you own a traditional IRA or other non-Roth IRA, or have an old workplace retirement plan such as a (k), (b), or (b), you can pay taxes on your. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You. To convert to Roth, you would pay approximately $12, in taxes today, but in 20 years, you could have $22, more in total assets, which may make a Roth.

Payments can be made via Quick Pay or in My Tax Account · Complete and print the interactive Form 1-ES Voucher · Call the department at () to request. or by not replacing amounts withheld for federal income tax), the IRA assets used to pay those taxes may be considered a premature distribution (if you are. Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. Payment Due Dates ; First Quarter (Q1) 1 January – 31 March, April 15, ; Second Quarter (Q2) 1 April – 30 June, June 17, ; Third Quarter (Q3) 1 July – For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. If you own a traditional IRA or other non-Roth IRA, or have an old workplace retirement plan such as a (k), (b), or (b), you can pay taxes on your. estimated tax liability for the taxable year. The declaration is IRA/SEP employee only; or; IRA/SEP employee plus spousal arrangement. Roth Conversions · Pay any Federal and state income tax liabilities that you incur by making Estimated Tax Payments in the quarter that you made the conversion. The conversion amount might raise your taxable income sufficiently enough to push you into a higher federal income tax bracket. Income from a conversion could. Use Form ES, Estimated Tax for Individuals, and the California Estimated Tax Worksheet, to determine if you owe estimated tax for and to figure. Payment Due Dates ; First Quarter (Q1) 1 January – 31 March, April 15, ; Second Quarter (Q2) 1 April – 30 June, June 17, ; Third Quarter (Q3) 1 July – A special exception has been created for conversions to Roth IRAs, so you won't pay a penalty on your conversion even if you're under age 59½. Estimated tax. How Much Tax Will I Pay If I Convert My Traditional IRA to a Roth IRA? Traditional IRAs are generally funded with pretax dollars; you pay income tax only when. For most calendar year filers, estimated payments are due April 15, June 15, and September 15 of the taxable year and January 15 of the following year. If you. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You. When converting your before-tax savings, you're including the converted amount as ordinary income, but without an IRS 10% additional tax for early or pre 1/2. When your actual taxes for a year are determined, you could incur IRS penalties if your estimated federal income tax payments were not sufficient. You may incur. For federal taxes, you can use the IRS Direct Pay system here: gulche.ru This method doesn't require you to create an account. You have two options for paying your estimated tax. You can pay it all at once when you make your first required installment, or you can pay it in quarterly. You must pay ordinary income tax on the amount converted (specifically, on pre-tax contributions and investment gains). · If you pay the taxes using money from.

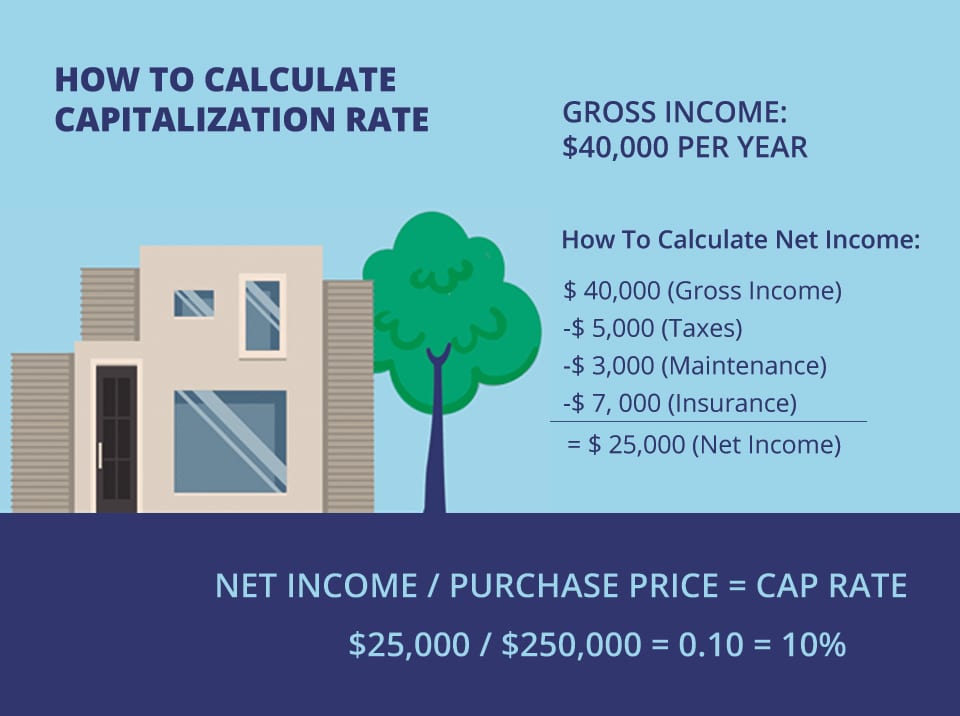

Define Capitalization Rate Real Estate

A property's capitalization rate, or “cap rate”, is a snapshot in time of a commercial real estate asset's return.¹ The cap rate is determined by taking the. One of the metrics most widely used by real estate investors is the capitalization rate, or cap rate. The cap rate is a useful tool to compare market. Cap rate is a handy tool for estimating the rates of return on multiple commercial real estate properties. Learn how to calculate cap rates using our guide. The relationship between cap rates and NOI is inverse, meaning that as cap rates decrease, the value of the property increases, and vice versa. This is due to. Capitalization rate (cap rate) is perhaps the most commonly used indicator of the expected return on a property investment. A cap rate for a property is. What is Cap Rate in Real Estate? A cap rate is a ratio that compares the net income of a property to its purchase price or current market value. It's. The cap rate is a valuation metric investors use to determine if a property is an attractive investment. It's like a price-to-earnings (PE) ratio for stocks. Cap rate (capitalization rate) is a metric used to measure the performance of a rental real estate property, providing an estimate of the potential return on. For real estate investments, Cap Rates are calculated by dividing your Net Operating Income (NOI), or Rent minus Expenses, by the market value of a property. A property's capitalization rate, or “cap rate”, is a snapshot in time of a commercial real estate asset's return.¹ The cap rate is determined by taking the. One of the metrics most widely used by real estate investors is the capitalization rate, or cap rate. The cap rate is a useful tool to compare market. Cap rate is a handy tool for estimating the rates of return on multiple commercial real estate properties. Learn how to calculate cap rates using our guide. The relationship between cap rates and NOI is inverse, meaning that as cap rates decrease, the value of the property increases, and vice versa. This is due to. Capitalization rate (cap rate) is perhaps the most commonly used indicator of the expected return on a property investment. A cap rate for a property is. What is Cap Rate in Real Estate? A cap rate is a ratio that compares the net income of a property to its purchase price or current market value. It's. The cap rate is a valuation metric investors use to determine if a property is an attractive investment. It's like a price-to-earnings (PE) ratio for stocks. Cap rate (capitalization rate) is a metric used to measure the performance of a rental real estate property, providing an estimate of the potential return on. For real estate investments, Cap Rates are calculated by dividing your Net Operating Income (NOI), or Rent minus Expenses, by the market value of a property.

It is calculated as net operating income divided by value. Yield is a real estate metric that measures the relationship between a property's income and its cost. Cap Rate, also known as capitalization rate, is a calculation that indicates the expected rate of return from a property or real estate investment. In commercial real estate investing, the capitalization rate is a percentage that indicates the rate of return on a property. Capitalization rates, also known. Defining Capitalization (Cap) Rate The capitalization rate, or cap rate, is a valuation method most commonly used in real estate investing and is based on a. The capitalization rate (Cap Rate) is used in real estate, refers to the rate of return on a property based on the net operating income of the property. First, let's break down the cap rate definition. A capitalization rate is a representation of risk and return on an investment asset. Expressed as a percentage. In the realm of real estate, the cap rate functions as a benchmark to determine and compare the return on investment for a variety of commercial and residential. The Capitalization Rate (Cap Rate) is a metric used to evaluate the performance of a commercial real estate investment. The Cap Rate is calculated by. The capitalization rate, also known as cap rate, is mostly used in CRE to indicate the rate of return, but it can also measure the level of risk that a. Description: Capitalization rate shows the potential rate of return on the real estate investment. The higher the capitalization rate, the better it is for the. What is a Cap Rate and How is it Calculated? A cap rate is a measure of the potential return on investment for a commercial property. To calculate the cap. The capitalization rate, or cap rate, is calculated by dividing the net operating income of a property by its market value. This is the key tool appraisers use. Cap rate shows you the net income ratio of a property compared to its market value. A positive cap rate means that the property is generating income. A high and. The cap rate is a ratio of two variables: net operating income and the current value or sale price of a property. Capitalization rate (or "cap rate") is a real estate valuation measure used to compare different real estate investments. Although there are many variations. What is Cap Rate? Cap Rate—short for Capitalization Rate—is a measure of the expected rate of return on a real estate investment, such as a commercial rental. And why is it important for an investment property? Capitalization rate (also known as cap rate) is the rate of return on a real estate investment. While cap. Next, divide the NOI by the acquisition cost for the property, including brokerage fee, closing costs, and all the renovation costs necessary to make it “rent. The cap rate is a property's net operating income divided by it's current market value. But what exactly is the importance of this number?

What Does Charge Off Mean On Credit Report

Collection or charged-off accounts: If you have a late payment and don't pay the past-due balance, the account could eventually be charged off by the original. A charge-off on your credit report indicates the financial institution or However, a charge-off does not mean your debt is forgiven—it may be. A charge-off is an unpaid debt that your creditor gave up on. It stays on your credit report for 7 years & is very damaging. Paying it off reduces its. Many financial businesses use charge-offs when a borrower has stopped making minimum payments for many months. There are several reasons a business may choose. If you've stopped paying your creditors for unpaid debts, they will likely report your account as a charge-off after four to six months of non-payment. Consumers with charge offs on their credit report will have difficulty obtaining any new credit. And what credit they are able to acquire will come with. A charged off account will be removed from your credit reports between 7 to 7,5 years after you first went delinquent on the account. The. How does a charge off affect your credit score? A charge-off is a negative entry on your credit report which could lower your credit score. It can affect. A charge-off or chargeoff is a declaration by a creditor (usually a credit card account) that an amount of debt is unlikely to be collected. Collection or charged-off accounts: If you have a late payment and don't pay the past-due balance, the account could eventually be charged off by the original. A charge-off on your credit report indicates the financial institution or However, a charge-off does not mean your debt is forgiven—it may be. A charge-off is an unpaid debt that your creditor gave up on. It stays on your credit report for 7 years & is very damaging. Paying it off reduces its. Many financial businesses use charge-offs when a borrower has stopped making minimum payments for many months. There are several reasons a business may choose. If you've stopped paying your creditors for unpaid debts, they will likely report your account as a charge-off after four to six months of non-payment. Consumers with charge offs on their credit report will have difficulty obtaining any new credit. And what credit they are able to acquire will come with. A charged off account will be removed from your credit reports between 7 to 7,5 years after you first went delinquent on the account. The. How does a charge off affect your credit score? A charge-off is a negative entry on your credit report which could lower your credit score. It can affect. A charge-off or chargeoff is a declaration by a creditor (usually a credit card account) that an amount of debt is unlikely to be collected.

Because an account is charged off does not mean the creditor lacks a legal right to collect the debt. To the contrary, the creditor may move the account to its. What Happens If a Charge-off Appears on My Credit Report? While the creditor considers the debt uncollectible, you are still obligated to pay it. · Federal. What Does it Mean to Settle a Charge-off? When a debt is settled, your credit report should be updated to show the debt has been “settled in full.” This is. Because an account is charged off does not mean the creditor lacks a legal right to collect the debt. To the contrary, the creditor may move the account to its. “Charge-off” means the business that gave you the loan, typically a card company or retailer, has written off the amount owed as uncollectable. Charge-offs refer to debts that lenders have written off as losses after deciding that they can no longer be collected. When they choose to do this, they “charge off” the debt. This means they write the loan off as a loss for the company, cancel your accounts, and likely report. A charged-off account does have significant implications for your credit health. When a lender considers your account as "charged off," it means. Many financial businesses use charge-offs when a borrower has stopped making minimum payments for many months. There are several reasons a business may choose. The worst rating you can receive is 9. It usually means the lender has written your account off or sent it to a collection agency. Number. Meaning. If your accounts have been charged off, there's nothing else you can do except start rebuilding your credit. There are several ways that creditors report a. What is a Charge-off? A charge-off is a financial term used by creditors when they consider a debt to be uncollectible, typically due to prolonged non-payment. Generally a Charge Off is a notation on a credit report that a lender places on an account when it has gone unpaid for a period of time. The account has moved. This is in part due to the lack of payment and increase in credit/utilization it will report. With 35% of your total credit score being calculated on payment. You may also see the charge-off on your credit report. Having a charge-off means that your creditor has written your charged-off account as a loss, which means. A charge-off indicates that your creditor has declared your debt as a loss, but it does not absolve you of responsibility. Charge-off accounts. In case one's debt gets marked as 'charged-off', they will be liable to pay back the entire due amount. However, simply making the repayment in full doesn't. Charge-off A charge-off or chargeoff is a declaration by a creditor (usually a credit card account) that an amount of debt is unlikely to be collected. This. What Does That Mean? A Guide to Equifax Credit Report Terminology Charge-Off: An account that is charged off means the lender or creditor has.

Sub Accounts In Bank Account

The most common way to set up a bank account or credit card account with multiple associated cards is to create a parent account, and then set up each. The Benefits of a Savings Account With Sub Accounts · An emergency fund · Buying a house · Home repairs and improvement · Motor vehicle. Sub accounts are instant and you can make a bunch, then set up auto transfers monthly and on direct deposit. Now, You have to select your sub-account type by clicking on the type tab and from the drop-down menu of Type, select Income, Expense, Liability, Asset, or Bank. This is the sub-accounts bank ISO code, use the List of Banks for Transfer endpoint to retrieve a list of bank codes. This is the sub-account business name. A subaccount is a feature associated with your Serve account that provides a convenient and flexible way to give another person age 13 or older access to your. Once your sub-account is opened, all additional users will have access and can complete transactions, move money, and make payments across all open accounts. You must be enrolled in Business Advantage , our small business online banking platform, and have an open Bank of America small business deposit account to. A sub-account is an optional character attribute that can be used to break down an account into multiple smaller accounts for better tracking of detailed. The most common way to set up a bank account or credit card account with multiple associated cards is to create a parent account, and then set up each. The Benefits of a Savings Account With Sub Accounts · An emergency fund · Buying a house · Home repairs and improvement · Motor vehicle. Sub accounts are instant and you can make a bunch, then set up auto transfers monthly and on direct deposit. Now, You have to select your sub-account type by clicking on the type tab and from the drop-down menu of Type, select Income, Expense, Liability, Asset, or Bank. This is the sub-accounts bank ISO code, use the List of Banks for Transfer endpoint to retrieve a list of bank codes. This is the sub-account business name. A subaccount is a feature associated with your Serve account that provides a convenient and flexible way to give another person age 13 or older access to your. Once your sub-account is opened, all additional users will have access and can complete transactions, move money, and make payments across all open accounts. You must be enrolled in Business Advantage , our small business online banking platform, and have an open Bank of America small business deposit account to. A sub-account is an optional character attribute that can be used to break down an account into multiple smaller accounts for better tracking of detailed.

The BANK SUB ACCOUNT is to enable bank reconciliation. A simple example will be when a checque is given to a vendor, the vendor will take some time to present. Sub-accounts can be used to help track expenses when several different activities may be funded by the same account. Budgets, actual activity, and encumbrances. Sub-accounts give you easy, online access to our flexiRate feature. This lets you lock in a higher interest rate on balances for fixed terms up to 12 months. Sub-accounts are child accounts created under a parent account. It helps to track the income and expense(s) of the parent account effectively. Using sub-accounts. Some savings accounts have a sub-savings account feature, which allows you to split funds in one primary savings account into separate. Benefits to you and your business. - Fast: Allows clients to monitor and manage their escrow and subaccounts online. For our institutional investment management clients, sub-accounting offers a comprehensive platform that can help manage multiple pooled investment accounts. Multiple accounts can make it easier to follow a monthly budget · By taking a modern-day approach to savings, you can update an old-fashioned method with all the. A sub-account is an account beyond your primary savings account that exists under the same account number. Examples of sub-accounts are checking accounts, daily. THEN. DO A FUNDS TRANSFER TO MOVE MONEY TO CORRECT BANK SUB ACCOUNT. 1. Record a single deposit ticket in Quick books for each sub account. Go to – Banking –. Traditional bank accounts normally arrive in two flavors - savings and checking. For each account, you apply and often pay a small fee and are then given an. Sub-accounts are basically a smaller savings accounts that sit under your main bank account. It typically just exists to work like an extra compartment in a. Set up the parent and subaccounts · Connect the accounts to Online Banking · Reconcile the account. an unlimited number of virtual sub-accounts within a single master bank account. With this solution, you can allocate deposits and other transactions to sub. A spendwell accountholder can have up to four (4) subaccounts per spendwell account. How do I add funds to a subaccount? Sub-accounts can be used as temporary holding accounts for cash that needs to be deposited into your main account later on. This way, each deposit will have its. When it comes to managing your money, many adults have, at a minimum, one checking account and one savings account at the same bank. Of course, there are. Sub-Accounts are an optional part of the accounting string that allows tracking of financial activity within a particular account, departments and schools. Get the flexibility and control you need to manage your business finances by adding sub-accounts that work just like your main account. Open account. Bluevine. A sub-account is owned by a verified user and tied directly to a master account on VoPay's platform that can act like a “wallet” for holding a stored value.

How Much For Ceiling Painting

For an average sized ceiling, all this might take me 6 hours, maybe even longer. Most decorators would charge by the day, but you may get some who are happy. But how much is the ceiling painting cost in India? The average cost of ceiling painting in India ranges from ₹10 to ₹50 per square foot. The actual cost. Ceiling work should be thousand depending on height and accessibility. Full paint should be 7 thousand give or take a few factors. I think. So to paint the ceiling it costs $ Help improve gulche.ru Report an Error. Become a member. The price for ceiling painting can vary from GBP per m². This is relatively low because a ceiling tends to have a large surface and can be painted. For a bedroom ceiling in Australia, painted by a professional, you're looking at an average cost range of $ to $ for a standard-sized room. Smaller jobs. The cost to paint a basement ceiling ranges between $1, and $2,, depending on the square footage. While the process for exposed ceilings is the same as. Factors that affect interior painting costs ; Square footage · sq. ft. $4,–$7, ; Room · Bedroom. $–$1, ; Ceiling height · 12 feet. $14,–$27, Interior Ceiling Painting Cost Per Square Foot. Painting ceilings costs $ to $ per square foot on average depending on the home. Although, it's very. For an average sized ceiling, all this might take me 6 hours, maybe even longer. Most decorators would charge by the day, but you may get some who are happy. But how much is the ceiling painting cost in India? The average cost of ceiling painting in India ranges from ₹10 to ₹50 per square foot. The actual cost. Ceiling work should be thousand depending on height and accessibility. Full paint should be 7 thousand give or take a few factors. I think. So to paint the ceiling it costs $ Help improve gulche.ru Report an Error. Become a member. The price for ceiling painting can vary from GBP per m². This is relatively low because a ceiling tends to have a large surface and can be painted. For a bedroom ceiling in Australia, painted by a professional, you're looking at an average cost range of $ to $ for a standard-sized room. Smaller jobs. The cost to paint a basement ceiling ranges between $1, and $2,, depending on the square footage. While the process for exposed ceilings is the same as. Factors that affect interior painting costs ; Square footage · sq. ft. $4,–$7, ; Room · Bedroom. $–$1, ; Ceiling height · 12 feet. $14,–$27, Interior Ceiling Painting Cost Per Square Foot. Painting ceilings costs $ to $ per square foot on average depending on the home. Although, it's very.

In April the cost to Paint a Wall starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized to the location. The average cost to paint a commercial building · - The going rate for labor is between $55 and $65 per hour · - How many hours will it take to complete my. Use our handy calculator to see how much ceiling paint is needed for your project. Enter ceiling dimensions in metres. Length. m. Before you start to paint any room or space, get help determining how much paint you need with our Paint Calculator or Estimator. The cost to paint a ceiling of a typical byfoot room runs from $ to $, with an average of around $ The cost depends on your location and the. And when it comes to painting and decorating your home, it's easy for ceilings to get overlooked. But, you'd be amazed at how much painted ceilings can. Backdrop pure flat ceiling paint in SUPERMOON white, low odor and low VOCs (volatile organic compounds). One gallon of Ceiling Paint will cover approximately square feet. One gallon of Primer will cover approximately square feet. *These estimates. The best way to paint a ceiling is to use ceiling paint and primer in one. It's formulated to spatter less and has a flat finish to help hide imperfections. A. There are over 2 special value prices on Ceiling Paint. What are white paint · ceiling white paint · 5 gallon ceiling paint · flat/matte. Do not paint a popcorn ceiling!!! You will be wetting it and causing it to lose its bond to the drywall. This can cause it to begin flaking. On average, the cost per square foot for basic interior wall painting ranges from INR 15 to INR If you opt for texture painting, the cost. Ceiling Painting Tips · Always use ceiling paint as opposed to wall paint. · Consider the color options. · Mildew and water stains will bleed through even the best. Interior Painting Pricing Guide (Current as of July ) ; Bathroom size 6' x 8' (w/8′ high ceiling) · $ – $ Ceilings, 2-Coats, $ – $ ; Standard 10'. Ceiling paint costs: $$ It is less expensive if included with the entire house project. Painting handrails or patio railing prices: $1-$ 5 per straight. For an average sized ceiling, all this might take me 6 hours, maybe even longer. Most decorators would charge by the day, but you may get some who are happy. So the painting estimate for a 1,square-foot house would be anywhere from $3,$5, plus HST. This is interior painting costs. Ceilings can cost between. Painting A Ceiling: · $ – $ · $ – $ · $2, – $3, As with the walls, to arrive at the ceiling's square footage, multiply its length by its width. Then, to determine the gallons of paint needed, divide that. Highlights · Hiring a pro for interior painting ensures quality work, expertise in dealing with room type and paint variables, and saves time. · The average cost.

Selling Home And Buying New Construction

The process to finance a home is similar, whether you're buying a brand-new home or purchasing an existing one. But if you plan to design and build a custom. The short answer is “Absolutely, yes.” Many people have the notion that using their own Realtor® to buy a new construction home will increase their cost—it. You can sell the contract to buy the house to someone else. Of course, since you were planning this ahead of time, you spoke to a lawyer ahead. However, some buyers do not want to live in a pre-owned home, and they would much rather have a brand new property. This type of purchase comes with its own set. Selling new construction homes can be a great opportunity for agents. Learn how to work with builders and find the right buyer for a new construction. To be an effective negotiator, you need to do your research. Find out what other new construction homes in the area are selling for and what features they offer. You don't want to wait too long and end up with a double mortgage. However, if you end up selling before your new-construction home is completed, you might. The Short Answer: You don't need a realtor when buying new construction because you can use the builder's sales agent. However, you lose third-party. Another financing option to build a new home is a construction-to-permanent loan. This is best suited for those with solid construction deadlines and a. The process to finance a home is similar, whether you're buying a brand-new home or purchasing an existing one. But if you plan to design and build a custom. The short answer is “Absolutely, yes.” Many people have the notion that using their own Realtor® to buy a new construction home will increase their cost—it. You can sell the contract to buy the house to someone else. Of course, since you were planning this ahead of time, you spoke to a lawyer ahead. However, some buyers do not want to live in a pre-owned home, and they would much rather have a brand new property. This type of purchase comes with its own set. Selling new construction homes can be a great opportunity for agents. Learn how to work with builders and find the right buyer for a new construction. To be an effective negotiator, you need to do your research. Find out what other new construction homes in the area are selling for and what features they offer. You don't want to wait too long and end up with a double mortgage. However, if you end up selling before your new-construction home is completed, you might. The Short Answer: You don't need a realtor when buying new construction because you can use the builder's sales agent. However, you lose third-party. Another financing option to build a new home is a construction-to-permanent loan. This is best suited for those with solid construction deadlines and a.

The model home is to entice you in buying their inventory and homes that will be build or customized for you. Your agent can also help you see the features of a. Buying a new home and selling your current home is possible, even in a competitive market. It's all about timing and understanding mortgage and financing. Get the funds you need to buy your new home with a all-cash cash offer. Move on your schedule. Align the close dates of your current and new homes anytime. Some buyers want the new build, but they don't have months to wait on construction. You'll get their attention, but you won't get the buyers who. When purchasing a home that has been previously owned, the earnest money on new construction is typically % of the sales price. When purchasing new. This article breaks down the costs of home building from the land to interior finishes. It includes additional costs and the main steps of building a house. Don't be afraid to negotiate with the builder. Often people feel like they can't ask for anything when buying a new house. And it's true, many builders. 5 Tips for Selling New Construction Homes to Modern Buyers · Focus on Affordability. Our current economy has created a market of cautious and smart shoppers. The closing date for a new-construction home is determined based on the home's expected completion date. But construction delays can happen due to weather or. Buyers of new homes in Montgomery County should call the Montgomery County Office of. Consumer Protection at to check whether a builder is licensed. The hardest part about buying a new house before selling the old one is the financial requirements. Go over your finances and determine your home buying budget. Understand the Role of a Buyer's Broker: Buyers need representation when purchasing new construction because builder salespeople are focused on the builder's. The hardest part about buying a new house before selling the old one is the financial requirements. Go over your finances and determine your home buying budget. This means they'll try to sell as many homes as possible, before they're even built. To accomplish this, they'll build out model homes and allow buyers to go in. The exterior of your home is a critical factor, especially when potential buyers are driving by to visit the builder's model. Enhance your curb appeal with. The process to finance a home is similar, whether you're buying a brand-new home or purchasing an existing one. But if you plan to design and build a custom. Builders need to sell homes so they can fund their new construction projects, so they bring the financing element in-house. To lure homebuyers toward new. 5 Simple Steps to Buying a Home · 1. Find Your Home · 2. Design & Purchase Your Home · 3. Build Your Home · 4. Close on Your Home · 5. Live in Your Home. But if you are purchasing a new home, one built from scratch on the lot of your choice to your own specifications, you should have plenty of time to sell your. In a new construction closing transaction, it's typical to see both the selling and the buying sides pay some of the closing costs. While the buyers typically.

How To Resell Concert Tickets

You can sell them at StubHub, Ticketmaster, and many other ticket reseller sites. If they are expensive tickets, then I would try StubHub or Ticketmaster. If you have an in-demand concert, you can start selling tickets several weeks or months before the concert date. Live events typically have a predictable sales. Sell event tickets from any device in a few steps. Massive Audience. Over million fans buying tickets per second on StubHub. Secure. Ticket To Cash is a free service for people to use to sell their concert tickets. First-time sellers will have a 15% commission deducted from their payout at. With Oveit you can sell tickets and merchandise at the same time. Use our ticket addon features or our cashless payments tools to transform your event into a. Sell tickets online with viagogo | Sell concert tickets, theatre tickets and sports tickets - listing is FREE! You can use platforms like Ticketmaster or other reputable resale websites. However, be aware of local laws, buy legitimate tickets, set fair. TicketSwap is the safest way to buy and sell tickets for all types of events! Download our app and start buying and selling tickets for concerts, festivals. To sell concert tickets online, start by choosing a resale website, such as StubHub or TickPick. Once you've chosen one or more sites, register and set up an. You can sell them at StubHub, Ticketmaster, and many other ticket reseller sites. If they are expensive tickets, then I would try StubHub or Ticketmaster. If you have an in-demand concert, you can start selling tickets several weeks or months before the concert date. Live events typically have a predictable sales. Sell event tickets from any device in a few steps. Massive Audience. Over million fans buying tickets per second on StubHub. Secure. Ticket To Cash is a free service for people to use to sell their concert tickets. First-time sellers will have a 15% commission deducted from their payout at. With Oveit you can sell tickets and merchandise at the same time. Use our ticket addon features or our cashless payments tools to transform your event into a. Sell tickets online with viagogo | Sell concert tickets, theatre tickets and sports tickets - listing is FREE! You can use platforms like Ticketmaster or other reputable resale websites. However, be aware of local laws, buy legitimate tickets, set fair. TicketSwap is the safest way to buy and sell tickets for all types of events! Download our app and start buying and selling tickets for concerts, festivals. To sell concert tickets online, start by choosing a resale website, such as StubHub or TickPick. Once you've chosen one or more sites, register and set up an.

You can list tickets for sale on SeatGeek's Marketplace by visiting the Tickets tab on our website or app and then selecting "Sell" at the top of the screen. In this comprehensive guide, we'll give you the whole scoop on how you can sell concert tickets in a jiffy. How do I list my tickets for resale? · Sign into your Front Gate Tickets account via your event's purchase page · Select Order History from the Your Account drop. Do you have tickets and a parking pass to the game? Or maybe you want to sell concert tickets. Well, you're covered with Tickets For Less. We buy any sports. If you're looking to resell tickets for an in-demand concert, festival, or sporting event, Ticketmaster and StubHub should be the first on your list. Online ticket marketplace where fans can buy and sell tickets to sports, concerts, and theater events nationwide. Sign into your My Account. · Select your order in the My Tickets section. · Click the Sell Tickets button. · Select the tickets you want to sell and click Continue. How do I sell my tickets? · You cannot sell “part” of a ticket. · If multiple tickets are issued for each day of a multi-day package, they can be listed. We pay you first! We're here to rid the world of ticket scammers and wasted event tickets! That's why we pay out quickly and securely via PayPal. You can sell your tickets easily with SeatGeek. Reach millions of fans to sell your tickets online with minimal fees. Sign up to sell your tickets today. Ticket resale is when you sell event tickets to others, typically at a price higher or lower than face value. It allows individuals to buy or sell tickets after. Find your listing and select “Edit Listing.” · Under “What Tickets to you have?” select the “Quantity” drop-down to choose how many tickets you want to sell. · If. TicketSwap is the safest way to buy and sell tickets for all types of events! Download our app and start buying and selling tickets for concerts, festivals. The fan-forward ticket marketplace. We've got you covered to sell tickets simply and get paid fast. Plus, buy tickets safely and enjoy peace of mind. The fan-forward ticket marketplace. We've got you covered to sell tickets simply and get paid fast. Plus, buy tickets safely and enjoy peace of mind. Sell Your Extra Tickets to TicketCity. We Purchase Tickets for Events, or Can Sell Your Tickets via Our Professional Consignment Program All Concerts. Top. Other states require that a seller have a license to resell tickets, and cap the amount over face value that a reseller may demand, but again, these rules are. theXchange is BY FAR the SAFEST ticket group on Facebook for music lovers to buy and sell concert tickets, without the stress of dealing with scammers. Sell Tickets Online. Create Your Event. It's easy to build an event and our platform has a wealth of features. · Food Festival Ticketing Software. Customizing.

What Is Interest Rate Mortgage

Your mortgage interest rate only covers the cost of borrowing a specific amount of money from a lender and is the actual rate used to calculate your monthly. The % interest rate reduction may not be combined with certain other discounts or promotions and may not be available for all home lending products. Other. A mortgage rate is the percentage of interest that is charged on a home loan. The precise rate you get depends on your credit score and is easily. NAR expects the year fixed mortgage rate to average % in its most recent quarterly forecast published in June, an increase from its previous forecast of. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. A fixed-rate mortgage has the same interest rate for the entire loan term. If you're applying for a fixed-rate loan, you'll receive a Loan Estimate from your. Interest rate refers to the annual cost of a loan to a borrower and is expressed as a percentage; APR is the annual cost of a loan to a borrower — including. The Year Fixed-Rate Mortgage Lingers Just Under Percent. August 22, Although mortgage rates have stayed relatively flat over the past couple of. The annual percentage rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the. Your mortgage interest rate only covers the cost of borrowing a specific amount of money from a lender and is the actual rate used to calculate your monthly. The % interest rate reduction may not be combined with certain other discounts or promotions and may not be available for all home lending products. Other. A mortgage rate is the percentage of interest that is charged on a home loan. The precise rate you get depends on your credit score and is easily. NAR expects the year fixed mortgage rate to average % in its most recent quarterly forecast published in June, an increase from its previous forecast of. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. A fixed-rate mortgage has the same interest rate for the entire loan term. If you're applying for a fixed-rate loan, you'll receive a Loan Estimate from your. Interest rate refers to the annual cost of a loan to a borrower and is expressed as a percentage; APR is the annual cost of a loan to a borrower — including. The Year Fixed-Rate Mortgage Lingers Just Under Percent. August 22, Although mortgage rates have stayed relatively flat over the past couple of. The annual percentage rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the.

Conventional loans like this may also have lower interest rates than jumbo loans, FHA loans or VA loans. The conventional fixed-rate mortgage allows for a. The current average year fixed mortgage rate fell 5 basis points from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 25 pm EST. A mortgage interest rate is the percentage you pay to borrow money for a home loan. Interest rate is part of the annual percentage rate, or APR. If you subtract. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. A VA loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included; therefore. A mortgage rate is the percentage of interest that is charged for a home loan. Broadly speaking, mortgage rates change with the economic conditions that. How does mortgage interest work? Generally, mortgage interest rates follow the Bank of England's base rate. For example, if you have a tracker mortgage at 1%. A mortgage rate is the interest rate you pay on the money you borrow to buy your house. A lower mortgage rate makes homes more affordable because it costs. The interest is the cost of borrowing that money. Mortgage interest is calculated as a percentage of the remaining principal. With most mortgages, you pay back. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. NerdWallet's mortgage rate insight On Monday, August 26, , the average APR on a year fixed-rate mortgage fell 1 basis point to %. The average APR. Fixed-rate mortgages are a type of amortized loan. You pay fixed monthly payments that are applied to both the principal and interest until the loan is paid in. Fixed-rate mortgage. With a fixed-rate mortgage, your interest rate stays the same from the time you get the loan until you pay it off. That's true. What do the results mean? Results will show you a snapshot of mortgage rates and corresponding annual percentage rate (APR) for competitive programs that PNC. The standard mortgage in the US accrues interest monthly, meaning that the amount due the lender is calculated a month at a time. There are some mortgages. Fixed-rate mortgages are a type of amortized loan. You pay fixed monthly payments that are applied to both the principal and interest until the loan is paid in. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%.

How Much House Can You Afford With 150k Salary

How much house can I afford based on my salary? Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to. can I afford? How much do I need to make to afford a $, home? And how much can I qualify for with my current income? We're able to do this by not only. Your monthly mortgage would be between $3, to $4, In that case, your first year interest portion of the payments would be $22K to $44K. But your DTI is also a crucial factor in figuring out how much house you can truly afford. For starters, you could ask for a raise in salary or you could work. The smaller the down payment, the higher your monthly payment will be. This increases the annual salary required in order to qualify for a mortgage of that size. The most common rule for deciding if you can afford a home is the 28 percent one, though many are out there. You should buy a property that won't take anything. You can afford to pay $3, per month for a mortgage. That would be a mortgage amount of $, With a down payment of $, the total house price would. 22M posts. Discover videos related to How Much House Can You Afford with k Salary on TikTok. See more videos about House I Can Afford with k Salary. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. How much house can I afford based on my salary? Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to. can I afford? How much do I need to make to afford a $, home? And how much can I qualify for with my current income? We're able to do this by not only. Your monthly mortgage would be between $3, to $4, In that case, your first year interest portion of the payments would be $22K to $44K. But your DTI is also a crucial factor in figuring out how much house you can truly afford. For starters, you could ask for a raise in salary or you could work. The smaller the down payment, the higher your monthly payment will be. This increases the annual salary required in order to qualify for a mortgage of that size. The most common rule for deciding if you can afford a home is the 28 percent one, though many are out there. You should buy a property that won't take anything. You can afford to pay $3, per month for a mortgage. That would be a mortgage amount of $, With a down payment of $, the total house price would. 22M posts. Discover videos related to How Much House Can You Afford with k Salary on TikTok. See more videos about House I Can Afford with k Salary. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit.

A conventional loan is a type of mortgage that is not insured or guaranteed by the government. Debt payments. Debt payments are payments you make to pay back. How much house can I afford calculator · Closing costs calculator · Cost of how much you'd pay for the type of home you want. Down payment: This is the. Historically, renters needed an annual income of at least three times the monthly rent. However, with rising rental prices, many landlords now require a x. This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The sum of the monthly mortgage. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. Calculate loan amounts and mortgage payments for two scenarios; one using aggressive underwriting guidelines and another using conservative guidelines. $1, monthly mortgage payment (No monthly mortgage insurance), $14, total closing costs. Share. More from SmartAsset. How much house can you afford? How many times my salary can I borrow for a mortgage? Assuming you have no debt, a healthy down payment and have been offered a low interest rate, you might. How Much House Can I Afford? (K Salary) · The smart way to shop for your new home! · On to the next hurdle · Let's consider someone with a K annual income. A down payment is a portion of the cost of a home that you pay up front. How much house can I afford? Determine how much house you could afford. Take. A mortgage on k salary, using the rule, means you could afford $, ($,00 x ). With a percent interest rate and a year term, your. You can afford a $, house. Monthly Mortgage Payment. Your mortgage payment for a $, house will be $2, This is based on a 5% interest rate and a. How much house can I afford? ; $, Home Price ; $1, Monthly Payment ; 28%. Debt to Income. To afford a house that costs $, with a down payment of $30,, you'd need to earn $32, per year before tax. The mortgage payment would be $ / month. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. Qualifying for one of the many types of FHA refinances can be easier than with other programs thanks to this loan's relaxed requirements. by Jonathan Davis in. Use this calculator to better understand how much you can afford to pay for a house and what the monthly payment will be with a VA Home Loan. Canada Mortgage Qualification. Qualifier to Calculate How Much Mortgage I Can Afford on My Salary. Canada Mortgage Qualification Calculator. The first steps. How much home can you afford? Use this calculator to determine the home price and monthly housing cost you can afford. You may be able to afford a home worth. This means your gross income would need to be around $16, per month ($, per year) to keep your monthly mortgage payment below that 28% threshold. The.

1 2 3 4 5